The Theme for 2016: Housing Affordability

As we begin to close the door on 2015, economists at Zillow reveal their predictions regarding the upcoming housing market trends of 2016.

High demand along with a persistent lack of inventory are the main culprits behind the recent increase in overall home price. Zillow’s experts suggest not to “expect a dramatic rise in home sales over the next few months. The winter season might be the ideal time to get a jump on your listing strategies”.

Here is a list of five 2016 housing market predictions to help you prepare for the year ahead.

Zillow’s 2016 Housing Market Predictions

- The median age of first-time home buyers will set a new record in 2016. Buyers are already about three years older, on average, than they were in the 1980s.

- More low-income Americans will be priced out of homeownership. Home values are rising faster than incomes, so in 2016, the poorest Americans will be unable to afford even the least expensive homes.

- Rents will soar in 2016, bringing the highest median rents ever.

- People will move outside cities to find affordable homes, and that will change the suburbs. Hot spots for 2016 will be dense, walkable suburbs with urban amenities.

- More than 100 economic and housing experts in the latest Zillow Home Price Expectations Survey pinned home value growth at about 3.5 percent in 2016.

Understanding the millennial mindset

It should be pretty clear by now that millennials want to purchase homes. The habits of this cohort of young adults — born between the early 1980s and the early 2000s — and other first-time home buyers are a notable departure from the Gen Xers and baby boomers, especially when it comes to housing.

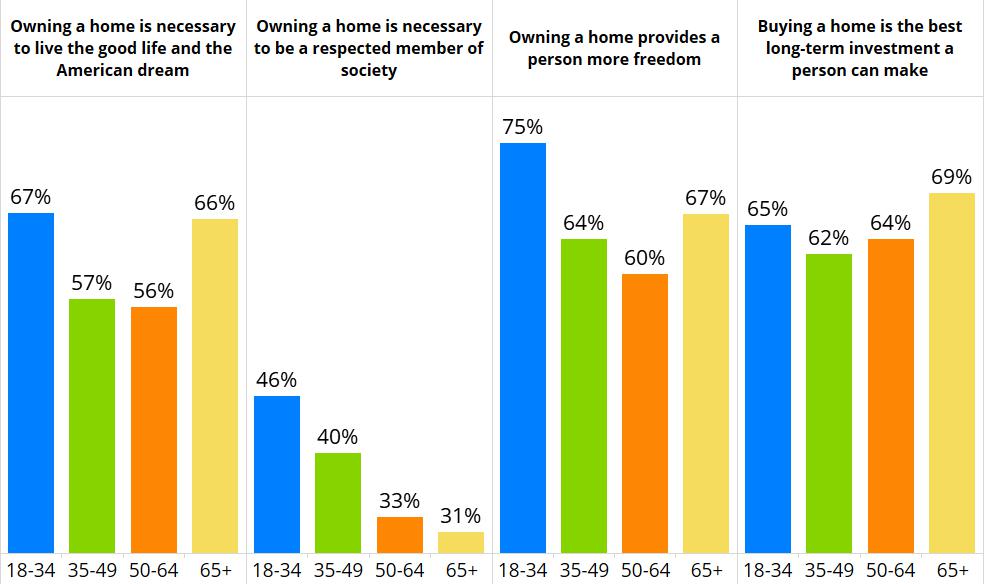

The most recent Zillow data shows that millennials have conservative views of homeownership.

Millennials (18-34) have conservative views on homeownership.

However, low interest rates and affordable mortgage payments are encouraging, and skyrocketing rents are compelling motivation for them to make a change in their housing situation.

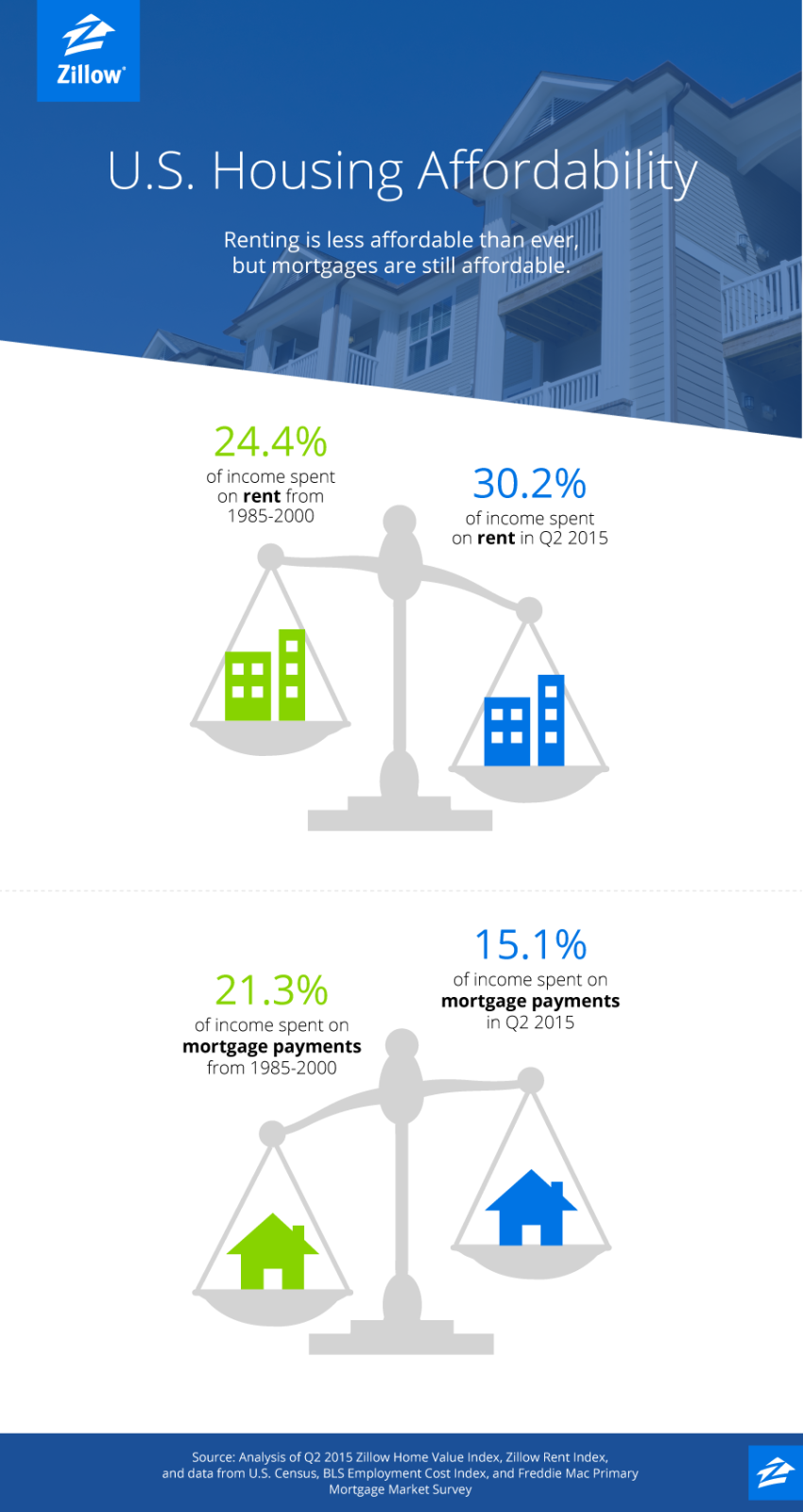

Rent has become increasingly unaffordable.

The question isn’t “Why don’t millennials want to buy a home?” It’s “When and what can they afford to buy?” It’s up to you to help them answer that.

The rent or buy decision—help guide your clients

The issue facing millennials and other first-time home buyers is whether it’s more economical to continue renting or to make the leap and purchase a home. To help determine that, renters need to identify their breakeven horizon — the number of years they will need to own and live in a home until it becomes more financially advantageous than renting the same home.

Current renters spend roughly 30 percent of their household income on housing; home buyers spend about 15 percent of their monthly income on a mortgage payment for a typical home.

Spending a bigger piece of the income pie on rent makes it hard to save for a down payment.

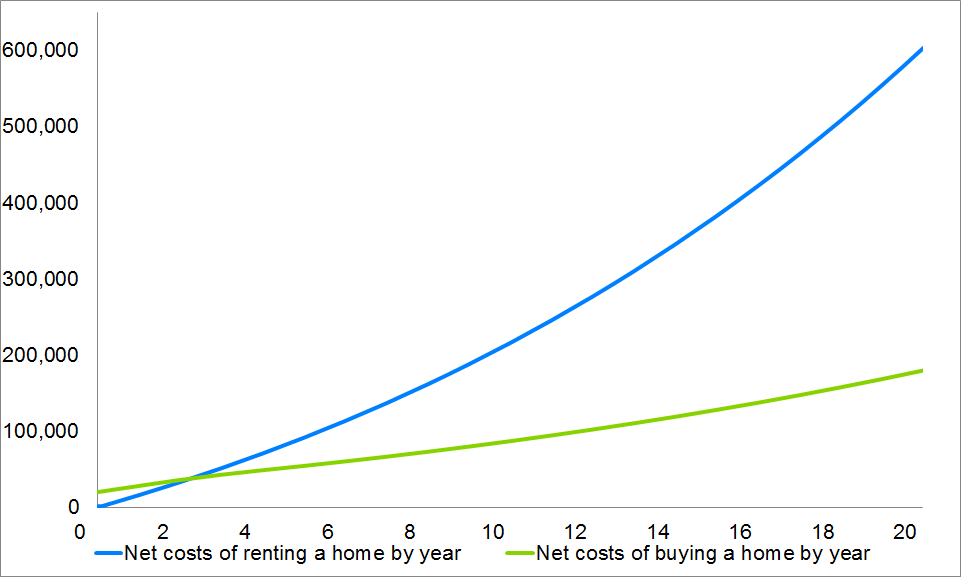

Although 20 percent is a recommended down payment, the graph below shows that even assuming only 5 percent down and a 6 percent mortgage interest rate, the breakeven horizon is just short of four years, and rental costs are still remarkably higher than homeownership costs by approximately $300,000 over 20 years.

With 5% down and a 6% interest rate, the breakeven horizon is just under 4 years.

“But maybe your clients like living with roommates and paying only $600 a month on rent…” – Dr. Skylar Olsen, Zillow Group senior economist

A sign of the times is that first-time home buyers are getting help from their social networks to make the down payment: 22 percent received a loan or financial gift from family and friends.* Of those buyers, 47 percent received an amount between $17,500 and $54,500.

* Zillow analysis of Federal Reserve Board, Survey of Household Economics and Decisionmaking, 2014.

Nearly half of first-time home buyers receive sizable loans and financial gifts for a down payment.

If this post leaves you thirsty for more, here is the entire presentation on Winter 2016 Housing Market Trends by Dr. Skylar Olsen (Senior Economist, Data Science and Economics).

To see the original article published in Zillow, click Here.

Published on 2015-12-14 11:51:34