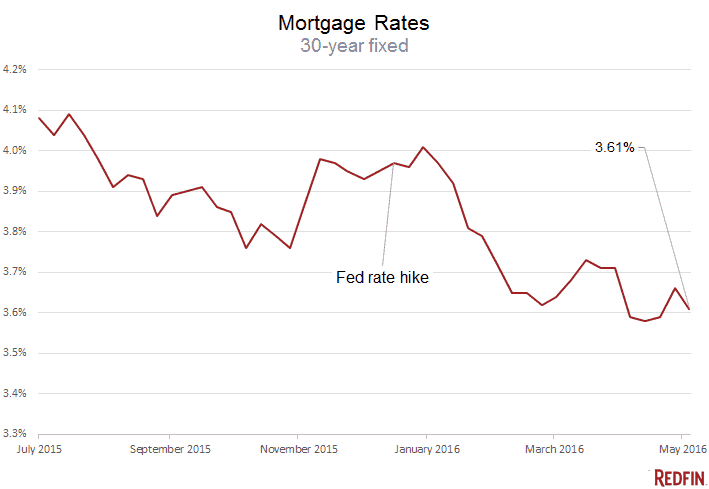

Home loans have been getting cheaper since December, when the Federal Reserve raised its benchmark rate on short-term loans. Fed Chair Janet Yellen and her team left that rate unchanged at their meeting last month.

“The Fed’s decision to stand pat followed by a week of assorted unsettling news drove Treasury yields lower,” Freddie chief economist Sean Becketti said. “Since the start of February, mortgage rates have varied within a narrow range, providing an extended period for house hunters to take advantage.”

Yellen & Co. did signal in April that they were feeling better about the economy’s health, particularly global risks. Still, odds are good they won’t raise rates at their June meeting, either. We’ll know more tomorrow, when we get a report on April job creation from the Labor Department.

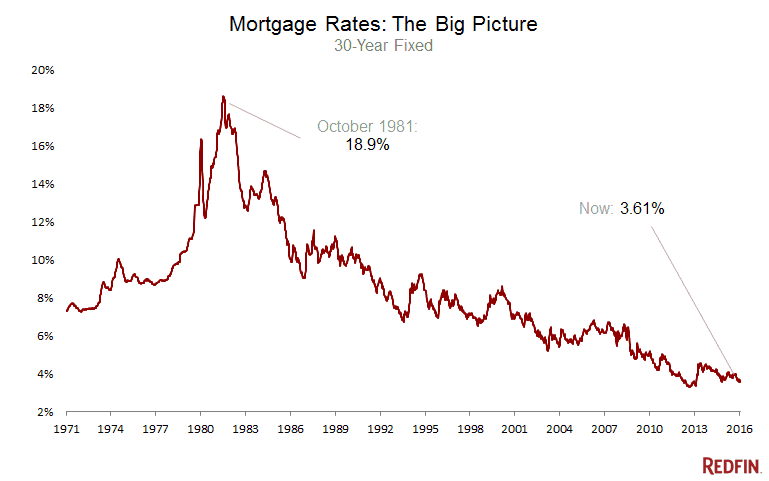

Remember, the Fed doesn’t control mortgage rates, but what they do can affect borrowing costs. For now, home loans are really cheap. Here’s the big picture.